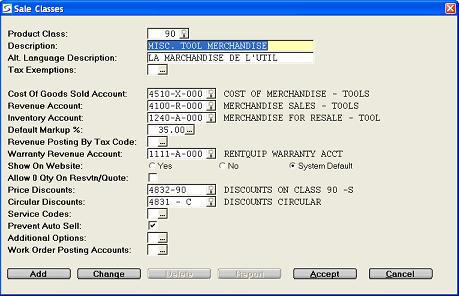

- PRODUCT CLASS

- Accept the default product class number displayed or over-type

it with the number for this class. Use up to five characters.

Note: Product Class numbers, Group numbers, Website Category numbers and Subcategory numbers cannot contain the "|" (pipe) character as this is not interpreted correctly in a browser, and an error will be triggered preventing its use.

The Product Class number sequence is controlled by Last Used Transactions, for module RSPC. The value in the TRX # column is the last assigned Class #. The value in the Running Balance column is the increment, by which the auto-assign number is the next Class #.

In Change mode a window is provided to select an existing Product Class as outlined in Product Class Search.

Note: Once a Product Class has been assigned to Sales Inventory it can be changed using the Update Class/Group/Vendor on Product utility.

DESCRIPTION- Describe this product class. Use up to 30 characters.

ALT LANGUAGE DESCRIPTION- If your firm utilizes the Alternate Language feature as

activated in the Company Miscellaneous

Parameters, enter the alternate description for the name of

this class.

This name will print on documents and reports for customers that are flagged to reflect the alternate language verbiage.

TAXES

There are two tax processing methods, each of which impacts this product class differently.

Refer to Tax Codes Maintenance to review the regulations determining the tax selection using the either taxing method.-

- Standard Taxing

For the standard simple tax processing that handles two tax codes, the Tax prompts include:- CHARGE TAX CODE 1

- Check this box if sales parts in the class should be charged

Tax 1 as defined for the customer or division.

Uncheck this box if products in the class are exempt from Tax 1.

CHARGE TAX CODE 2- Check this box if sales parts in the class should be charged

Tax 2 as defined for the customer or division.

Uncheck this box if products in the class are exempt from Tax 2.

-

Enhanced Taxing

The purpose of the Enhanced Tax method is to allow more than two tax codes to be tracked according to Location, and to be charged on products, services, and Damage Waivers, and to allow for tax exemptions on any or all of these charges.

The Enhanced taxing method can be activated in the Company Taxing Parameters.- TAX EXEMPTIONS

- This field provides a Tax Exemptions

window to enter or update tax exemptions for products in this

Product Class as explained in Tax Exemptions

By Class.

Class exemptions apply regardless of Site, Customer, or Division taxes.

- Standard Taxing

COST OF GOODS SOLD- Enter an Expense account that will be debited with the cost of

the sales item when sold, or select it from the window, searching

by account number or account description.

Example: Acct# 4510 Cost Of Merchandise Sold

REVENUE ACCOUNT- Enter a Revenue account that will be credited with the sales

income when a sales item when sold, or select it from the window,

searching by account number or account description.

Example: Acct# 4100 Merchandise Sales.

INVENTORY ACCOUNT- Enter an Asset account that will be debited with the cost of

the sales item when the sales item is purchased, or select it from

the window, searching by account number or account description.

(This account also gets credited with the cost of the sales item

when it is sold).

Example: Acct# 1240 Merchandise For Re-sale inventory account.The type of GL account assigned to the Class as the "Inventory" posting account, also controls how the Inventory Yes or No flag is set when new Sales parts are "auto-added" into Sales Inventory.

Refer to Inventory Flag Defaults for information on this default.Note: When a product is ordered on a Purchase Order the Inventory posting account can be changed for that specific order, if the Allow Override Of GL Account On PO Details setting in the Company Security Parameters.

DEFAULT MARKUP %- Enter the markup percentage used to calculate the list price

from the cost of the inventory in this Product Class. e.g. Enter

30% as 30.00

A 30% Markup is calculated as COST x (100 + 30.00)Alternatively, window to enter a desired Margin Amount to be used to calculate the Markup %, as outlined in Markup Based on Margin Calculator.

REVENUE POSTING BY TAX CODE- Skip this field if the revenue should be posted according to

the Revenue Account selected above. This is the standard

method.

In special situations, a Revenue Posting By Tax Code can be defined in the window, so that if an invoice for a sales item in this class is posted charging a Tax Code listed here, it will post the revenue to the corresponding Revenue Account associated with the Tax Code in this window.

If the tax code is not included in this list, the Revenue will be posted to the standard Revenue Account assigned to this Product Class.Revenue Posting By Tax Code window:

- TAX CODE

- Enter a Tax Code, or select a code from the drop-down list.

- DESCRIPTION

- The Tax description displays as setup in Tax Codes .

- REV ACCT

- Enter a G/L Revenue Account, or select one from the G/L Account Search window.

Invoices for sales products in this class with this tax code will post the revenue to this G/L Account. - DESCRIPTION

- The description of the G/L account displays.

WARRANTY REVENUE ACCOUNT- Enter the revenue account to be credited when Sales parts from this class are used on a W.O., for equipment covered under a Supplier's warranty, or select it from the window, searching by account number or account description.

WEBSITE OPTIONS- Window to view the website options associate with that rental

equipment in this Rental Product Class.

- SHOW ON WEBSITE

- Select one of the following options:

- Select Yes if this Product Class should be displayed on the website.

- Select No to prevent this class from showing on the website.

- Select System Default if the display flag should reflect the value set in Show on Website Default in Global Portal Settings.

BITMAP IMAGE NAME- Enter an optional image name for the picture representing this group on the website.

INTERNET DESCRIPTION- An optional description can be entered for this class that

replaces the primary class description on the Portal

screens.

This can be useful if your descriptions are geared for staff use, and a more public description is required for web users.

WEBSITE CATEGORIES- Categories of two to four levels can be used to organize how inventory is displayed for web services, as setup in the Website Categories window.

These setting to display the class on the website apply to both the Portal as outlined in Portal Overview.

This flag and the image names can also be setup for classes in Inventory/Division Settings.

Flags in Equipment Groups and in Sales Inventory also control products displayed on the website.

ALLOW ZERO QTY ON RESERVATION/QUOTE- This setting controls whether the sales products in this class

or the Group for this class, can be included on a Worksheet,

Reservation, or Rental Quote, with a zero quantity.

Uncheck this box if products in this class should not allow a zero quantity on Counter Worksheet, Quotations, and Reservations.

This is the default setting for sales Product Classes.Check this box to allow sales parts from this class to be entered with a zero quantity on Counter Worksheet, Quotations, and Reservations.

If an item still has a zero quantity when the document is converted to a contract then that line item is omitted from the new contract.Note: Non-bulk rental products and serialized sales parts must always have a quantity of 1 or -1, regardless of the Product Class flag.

PRICE DISCOUNTS- This parameter is only enabled if Post Document Discounts To

G/L has been activated in the Company

Posting Parameters.

When discounts are posted separately, the gross product charge is posted as a Credit to the product Revenue account and any discounted amounts are posted as Debits to the Discount Expense account.Enter the G/L Expense account to track discounts given through rate/price over-rides and discount percents given for products on the document.

CIRCULAR DISCOUNTS- This parameter only appears if Post Document Discounts To

G/L has been activated in the Company

Posting Parameters.

When discounts are posted separately, the gross product charge is posted as a Credit to the product Revenue account and any discounted amounts are posted as Debits to the Discount Expense account.Enter the default G/L Expense account to track discounts given through Circular pricing as setup in Circular Pricing.

SERVICE CODES- Optional Service Charges can be associated with a sales product class so that when a product in the class is sold, a flat rate or a percent of the sale price can be automatically charged for the related services or fees, as outlined in Product Class Service Codes.

PREVENT AUTO SELL- The ability to automatically sell sales products at the time

they are put out on a contract can be activated when the Cycle

Bill Items From Contract flag is set to Automatic in the

Divisional Contract Parameters.

Uncheck this box if sales parts in this class should be processed as sold automatically when they are put on a contract, per the Divisional Contract Parameters flag.

Check this box to prevent sales parts in this class from being sold on the contract and invoiced automatically, even if the auto-sell feature is activated.

This does not prevent sales items from being manually selected and billed from Cycle Bill a Single Contract.Note: If the Ignore Prevent Auto Sell Class Setting flag is also set in the Divisional Contract Parameters, this over-rides the Class Prevent Auto Sell flag for that specific division.

WORK ORDER POSTING ACCOUNTS- During Work Order entry the operator

is prompted for a mandatory Work Order Posting Type that is

used to identify the processing path for this service transaction

to control the GL accounts for W.O. posting of parts used.

Internal maintenance repairs on products included in Sales Inventory / Rental Inventory and Standard Work Orders, post parts used values to the standard Cost Of Goods Sold and Revenue Account defined above.

A window is provided to enter default posting accounts for parts used on equipment service Work Orders relating to the customer, as follows:-

- COST OF GOODS SOLD - CUSTOMER DAMAGE

- Enter the Expense account to be debited with the cost of sales parts used on Work Order repairs to rented equipment caused by customer damage, or select it from the G/L Account Search window.

- REVENUE ACCOUNT - CUSTOMER DAMAGE

- Enter the Sales Revenue account to be credited with the revenue for the sales parts used on Work Order repairs to rented equipment caused by customer damage, or select it from the search window.

COST OF GOODS SOLD - CUSTOMER REPAIR- Enter the Expense account to be debited with the cost of sales parts used on Work Order repairs done on equipment owned by the customer, or select it from the G/L Account Search window.

- REVENUE ACCOUNT - CUSTOMER REPAIR

- Enter the Sales Revenue account to be credited with the revenue for the sales parts used on Work Order repairs done on equipment owned by the customer, or select it from the search window.

-

FILE ATTACHMENTS- Multiple external documents or images can be associated with

this class when setup in the File

Attachments window.

This field is disabled if there is no attachment directory defined in Company Miscellaneous Parameters.

ADDITIONAL OPTIONS- Window to view additional conditions that can be activated for

products in this Sales Product Class.

- ALLOW CREATE P.O. FROM CONTRACT

- Uncheck this box if a P.O. should not be generated when sales

products in this class are entered on a contract.

Check this box if the operator should have the ability to create a Purchase Orders for sales products in this class from a Contract as explained in Contract/Purchase Order Link Overview.

This processing does NOT apply to sales products that are serialized, or if the selected vendor uses a conversion factor as defined in Inventory Re-Order Information or in Alternate Vendor Purchasing.

Order by location is not used in this processing. The new order is always for the location defined on the P.O./Contract link.Define the following two G/L Accounts for processing an Accrual transaction from the P.O./Contract Accrual Report.

- P.O. ACCRUAL EXPENSE ACCOUNT

- Enter the G/L expense account number or select one from the G/L Account Search window, to which to post the Debit and reversing Credit Accrual transactions from the P.O./Contract Accrual Report for relevant products in this class.

P.O. ACCRUAL LIABILITY ACCOUNT- Enter the G/L liability account number or select one from the G/L Account Search window, to which to post the Credit and reversing Debit Accrual transaction from the P.O./Contract Accrual Report for relevant products in this class.

DEFAULT REPAIR CHARGE CODE- This Repair Charge code becomes the default code in Close Internal Work Orders when repairs are processed for Sales products in this class.

EXEMPT FROM EARNING REWARDS- Check this box if sales products in this class should not

generate "Reward Dollars" for sales transactions on the

invoice.

Uncheck this box to allow customers to earn "Reward Dollars" on billed sales transactions for products in this class.For more information on this feature refer to the Reward Program Maintenance.

CANNOT BE PAID WITH REWARDS- Check this box to prevent "Reward Dollars" from being used to

pay invoiced amounts for sales products in this class.

Uncheck this box to allow "Reward Dollars" to be used to pay invoiced sales amounts for products in this class.

PREVENT SALES PRICE OVERRIDE- Check this box to prevent the 'Unit Price' for sales products

in this class from being changed in the counter document details

including Quotes, Reservations, Contracts and Invoices.

When this override restriction is selected only operators with a Security Role that allows the "Price Override of Restricted Sales Class Products" permission in the 'Document Field Access' settings, will be able to over-type the Unit Price in the document.Uncheck this box if the unit price for products in this class should not be "locked down" for any operator in counter documents.

Note: To enforce the restriction on price over-ride on documents, the option to "Allow over-ride of Extended Amount" in the Company Security Parameters should not be activated either.

Finished?- Click ACCEPT to accept the data, or CANCEL to abort.